Announced in April 2021, U.S. President Joe Biden’s American Families Plan is an ambitious proposal that aims to expand Americans’ access to childcare and education and increase the number of women in the workforce. The plan is to fund all of this through more taxes on higher-income earners and increased reporting requirements of banks that could potentially yield more tax revenue. These reporting requirements have caught the ire of a number of banks that took issue with this less widely known section of the plan.

A Facebook post by FNB Community Bank claimed: “The Biden administration has proposed requiring all community banks and other financial institutions to report to the IRS on all deposits and withdrawals through business and personal accounts worth more than $600 regardless of tax liability. This indiscriminate, comprehensive bank account reporting to the [Internal Revenue Service (IRS)] can soon be enacted in Congress and will create an unacceptable invasion of privacy for our customers.”

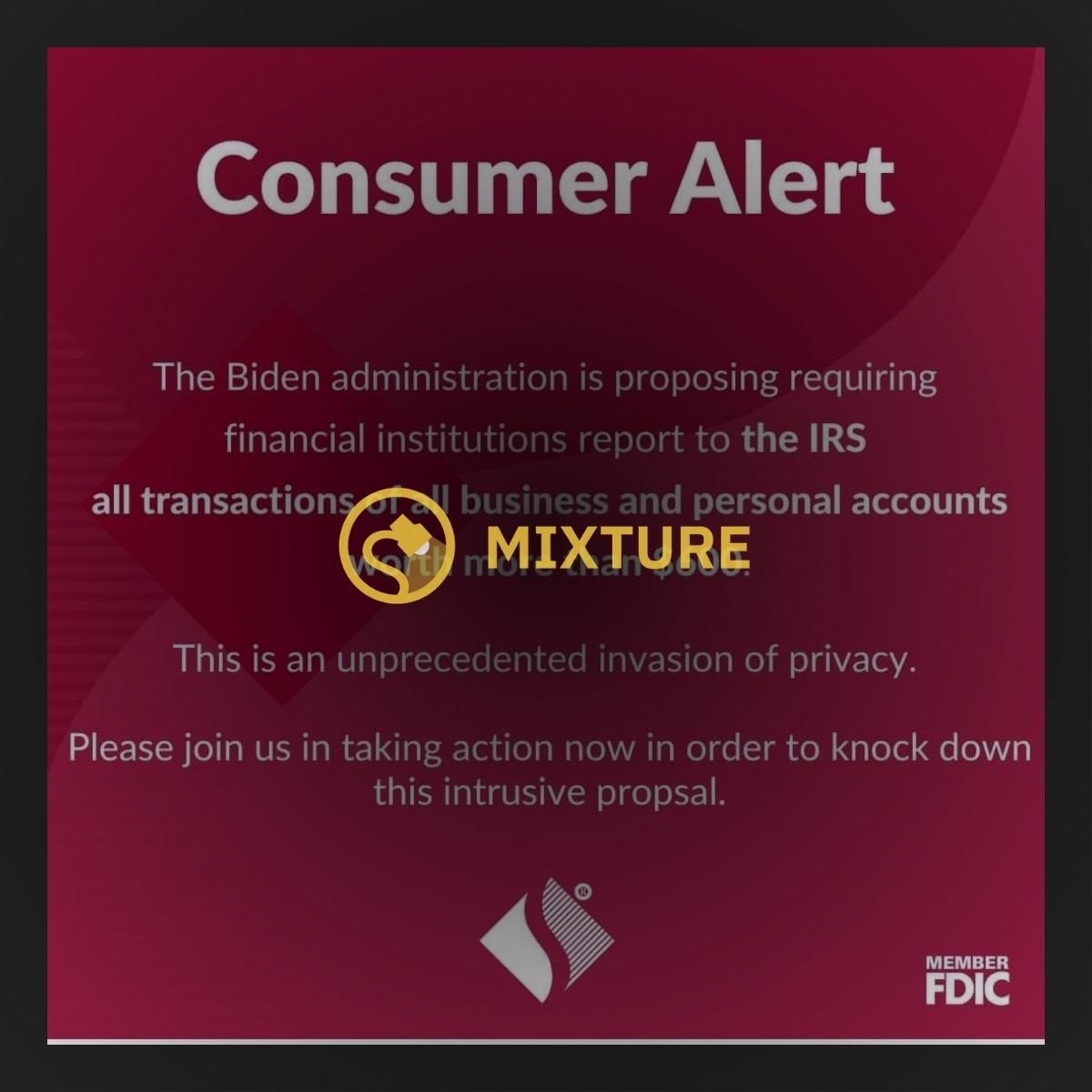

Another screenshot shared by our readers expressed similar concerns:

The Independent Community Bankers of America (ICBA) even began a campaign, calling on communities to send a letter to Biden to prevent this so-called “intrusive proposal”:

Tell Congress: Don’t Let IRS Invade My Privacy

The Biden administration is proposing requiring financial institutions report to the IRS all transactions of all business and personal accounts worth more than $600.

This is an unprecedented invasion of privacy.

In order to knock down this intrusive proposal, please send this letter to your representative and senators immediately.

We looked up the proposal itself, and it does require more robust reporting of transactions across business and personal accounts. The proposal, which aims to go into effect after Dec. 31, 2022, states:

This proposal would create a comprehensive financial account information reporting regime. Financial institutions would report data on financial accounts in an information return. The annual return will report gross inflows and outflows with a breakdown for physical cash, transactions with a foreign account, and transfers to and from another account with the same owner. This requirement would apply to all business and personal accounts from financial institutions, including bank, loan, and investment accounts, with the exception of accounts below a low de minimis gross flow threshold of $600 or fair market value of $600.

We begin by explaining some of the more technical terms in this proposal. A “de minimis threshold” is broadly defined as the amount of a transaction that has such a small value that accounting for it would be unreasonable. We spoke to Visiting Assistant Professor of Tax Law at New York University, Nyamagaga Gondwe, who explained, “It is the amount below which the [IRS] would argue isn’t worth investigating. It’s the difference between your company giving you a $5 card to Subway, versus traveling on a private jet on your company’s dime. [The latter] is worth reporting.” In this case, “gross flow” refers to the aggregate inflows and outflows of cash from bank accounts. In sum, the current proposal stipulates that an aggregate amount of less than $600 worth of cash flowing into and out of accounts is not worth reporting.

The “fair market value” refers to the amount people are willing to pay for an asset in the open market. In this case, Gondwe argued, the use of the term could possibly refer to the changing market value of transactions more than $600 that may occur in foreign currency transactions.

The ICBA claims that the proposal will make banks report “all transactions” above the limit, but this is misleading. While it is true that the IRS will have more information on cashflows above $600, that doesn’t mean they will have all the information pertaining to all transactions. The Center for American Progress (CAP) points out that banks will only be providing “aggregate numbers to the IRS after each year — gross inflow and gross outflow — and not individualized transaction information.” This reporting requirement would also extend to peer-to-peer payment services like Venmo, but wouldn’t require people to report any additional information to the government. According to The Wall Street Journal, financial institutions must already report interest, dividends, and investment incomes to the IRS, and the IRS can get other information through audits.

According to Marie Sapirie of Tax Notes, a publication focused on tax news, a parenthetical to the proposal indicates that there is some flexibility “on raising the minimum account balance/inflow/outflow above $600.”

The Tax Notes report also states that the treasury department estimated this form of reporting would raise $463 billion over the 10-year budget window, making it the third largest revenue raiser proposed in the budget. The aim is to target businesses outside of large corporations that carry out gross underreporting of their income in the amount of $166 billion per year. According to the proposal: “Requiring comprehensive information reporting on the inflows and outflows of financial accounts will increase the visibility of gross receipts and deductible expenses to the IRS. Increased visibility of business income will enhance the effectiveness of IRS enforcement measures and encourage voluntary compliance.”

Banks claim this would be an invasion of consumer privacy, with the ICBA saying it would allow the government to “monitor” account information. However, CAP analysts Seth Hanlon and Galen Hendricks argue, “Only the prior year’s total inflow and total outflow would be reported on annual forms. No one would say that the IRS “monitors” you on your job because it receives a W-2 from your employer with your total wages every January.”

Another challenge not mentioned in the ICBA’s consumer alert is the higher costs this reporting proposal may place on banks. In May 2021, a coalition of banking associations wrote a letter to the U.S. Senate Committee on Finance, arguing that they already give a lot of data to the IRS, and that this would impose additional costs on their systems:

The costs and other burdens imposed to collect and report account flow information would surpass the potential benefits from such a reporting scheme. New reporting would appear to require material development costs and process additions for financial institutions, as well as significant reconciliation and compliance burden on impacted taxpayers. For example, reporting total gross receipts and disbursements would require a new reporting paradigm for depository institutions, which necessitates system changes to collect the information.

On the flipside, Sapirie wrote for Tax Notes, the benefits of such a reporting proposal may be difficult to come by:

Increasing the amount of information flowing into the IRS would not in itself lead to increased enforcement, and it might come with added challenges. [Former IRS Commissioner Charles O.] Rossotti acknowledged that “the IRS today cannot use all the information it already receives, and significant areas of noncompliance are barely addressed, so more reporting alone will not solve the problem.” It would almost certainly have a deterrent effect for taxpayers contemplating evasion, but the extent of that effect is unclear, and it might be insufficient to justify the costs to financial institutions and the federal government of implementing such a large new reporting regime.

But CAP’s analysis argues that this will help prevent tax evasion, while also providing more funding to enhance data security for consumers:

Additional funding would go to enhancing data security. Even at present, the IRS’ data security is already much better than the financial industry, with only very rare and limited breaches compared to the exponentially bigger data breaches from financial institutions. Second, the reporting of information flows only from financial institutions to the IRS and not in the other direction, as some earlier proposals had called for.

[…]

The Biden administration’s bank reporting proposal is a critical element of the Build Back Better agenda. It gives the IRS some visibility into opaque forms of income that disproportionately accrue to high-income individuals. Despite fearmongering from bank lobbies, the proposal protects taxpayers’ privacy while simply requiring banks to provide basic, aggregated information about flows. That enables the IRS to select audits in a more efficient and equitable way so that the vast majority of taxpayers will be less likely to be audited. And by deterring and helping catch tax cheats, the proposal raises substantial revenue for the Build Back Better agenda, which provides critical investments to increase economic opportunities for American families and communities.

Whatever the impact of this proposal is, it does require additional reporting of certain bank transactions, just not in the way the above banks are portraying it. As such, we rate this claim a “Mixture.”

Sources:

“A Scorecard for Reconciliation, Round 2.” Tax Analysts, https://ift.tt/e0SLO2f. Accessed 15 Sept. 2021.

“Community Banks Must Engage Customers on New IRS Reporting Mandates.” ICBA, https://www.icba.org/newsroom/blogs/main-street-matters—advocacy/2021/08/19/community-banks-must-engage-customers-on-new-irs-reporting-mandates. Accessed 15 Sept. 2021.

“Consumer Alert from ICBA.” ICBA, https://ift.tt/EeRtJNl. Accessed 15 Sept. 2021.

“Digging Into the Bank Info Reporting Plan.” Tax Analysts, https://ift.tt/UrBF0Gi. Accessed 15 Sept. 2021.“Fair Market Value (FMV).” Investopedia, https://ift.tt/JP7GkoC. Accessed 16 Sept. 2021.

“General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals.” Department of the Treasury, May 2021, https://ift.tt/tbwdBO2. Accessed 15 Sept. 2021.

“Gross Cash Flow Definition.” Law Insider, https://www.lawinsider.com/dictionary/gross-cash-flow. Accessed 16 Sept. 2021.

Hanlon, Seth, and Galen Hendricks. “Bank Tax Reporting Is a Critical Component of Biden’s Build Back Better Agenda.” Center for American Progress, 14 Sept. 2021, https://ift.tt/UAwYCRu. Accessed 15 Sept. 2021.

“ICBA Urges House Panel to Reject IRS Monitoring Plan.” Default, https://ift.tt/9iM0b4q. Accessed 15 Sept. 2021.

Joint Trades Statement for the Record: Senate Subcommittee on Taxation and IRS Oversight Hearing Entitled: “Closing the Tax Gap: Lost Revenue from Noncompliance and the Role of Offshore Tax Evasion.” 10 May 2021, https://ift.tt/V6s2ubJ. Accessed 15 Sept. 2021.

Rubin, Orla McCaffrey and Richard. “Biden Tax Plan Leans on Banks to Help Find Unreported Income.” Wall Street Journal, 29 Apr. 2021. www.wsj.com, https://ift.tt/UsfB7xE. Accessed 15 Sept. 2021.

Tankersley, Jim, and Dana Goldstein. “Biden Details $1.8 Trillion Plan for Workers, Students and Families.” The New York Times, 28 Apr. 2021. NYTimes.com, https://ift.tt/AwPsFDU. Accessed 15 Sept. 2021.

“When Is a Minimal Fringe Benefit Not So Minimal?” https://ift.tt/AK84YBv. Accessed 16 Sept. 2021.

Will Banks Have To Report All Transactions Over $600 to IRS Under Biden Plan?

Source: Kapit Pinas

0 Comments